Solar Tax Incentives and Rebates for Commercial Projects

How Solar Tax Incentives Work for Businesses

Businesses considering solar installations often discover a major advantage: tax incentives can significantly offset the upfront costs of a commercial solar project. While many of these incentives apply nationally, understanding how they work is critical for accurately evaluating system ROI and total lifetime savings.

At Energy Independence Professionals (EIP), we stay up-to-date on the evolving landscape of solar tax benefits, including the Investment Tax Credit (ITC), Production Tax Credit (PTC), bonus depreciation, grants, and state-specific programs. We help our clients design smarter projects that fully capture available incentives.

Please note: EIP Consulting does not provide tax, legal, or accounting advice. Always consult your own professional advisors regarding your specific situation.

Federal Solar Investment Tax Credit (ITC)

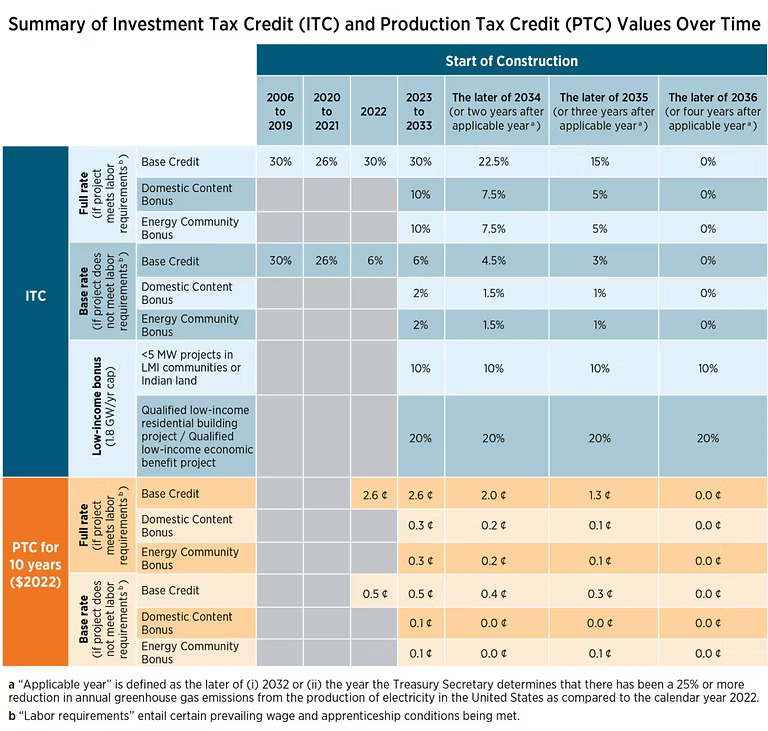

There is also a Production Tax Credit (PTC) available, which offers a per-kilowatt-hour tax credit for energy generated over a ten-year period. However, in most cases, a project can claim either the ITC or the PTC—not both—unless the IRS issues specific additional guidance for certain co-located solar and storage systems.

Solar systems must meet prevailing wage and apprenticeship labor requirements issued by the U.S. Treasury Department to qualify for the full incentive amounts (for projects over 1 MW).

Choosing Between the ITC and the PTC

In general:

- The ITC provides an upfront tax credit based on the total system cost, regardless of how much energy the system produces. This is usually better for smaller projects, projects with higher installation costs, or projects that qualify for bonus credits.

- The PTC provides ongoing tax credits over a ten-year period based on how much electricity the system generates. This can be more valuable for larger-scale projects located in areas with strong solar resources.

Each project is unique, and working with a qualified consultant ensures that you choose the credit structure that maximizes your return.

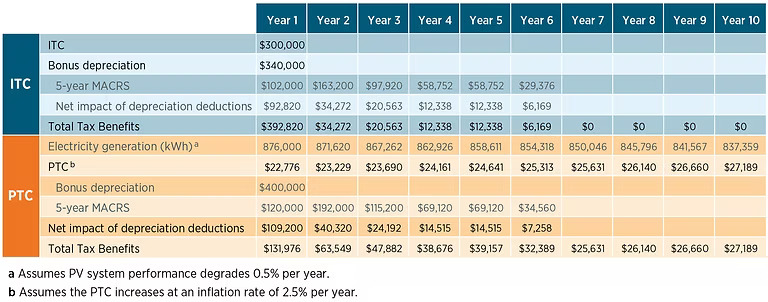

Accelerated Depreciation and Bonus Depreciation

Under current rules:

- Projects placed in service before 2027 qualify for bonus depreciation.

- Bonus depreciation allows a business to immediately deduct a large percentage of the project’s cost:

| Year Placed in Service | Bonus Depreciation Available |

|---|---|

| 2023 | 80% |

| 2024 | 60% |

| 2025 | 40% |

| 2026 | 20% |

MACRS and bonus depreciation provide significant additional tax benefits on top of the ITC or PTC, improving the project’s financial returns and reducing payback time.

Comparing the ITC & PTC With Bonus Depreciation

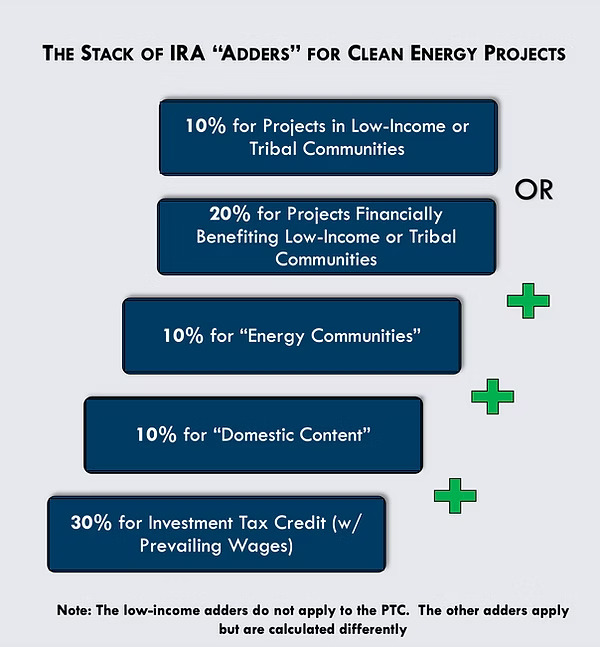

Available Bonus Credits

Domestic Content Bonus

Projects using American-made steel, iron, and solar components can earn an additional 10% on top of the ITC or PTC.

Eligible thresholds increase over time for manufactured goods sourced in the U.S.

Low-Income Community Bonus

Solar projects located in designated low-income communities or serving low-income housing may qualify for:

- A 10% bonus to the ITC, or

- A 20% bonus if the project provides direct financial benefits to residents.

Bonus awards are subject to a national program cap.

Energy Community Bonus

Solar projects built on brownfield sites, former fossil fuel extraction communities, or economically distressed regions may qualify for an additional 10% bonus under the Energy Community Tax Credit rules.

Direct Pay and Transferability

- Receive a direct payment from the IRS for tax credits if they qualify, or

- Sell (transfer) their earned credits to a third-party taxpayer. Additional information on the transfer credit program can be found on the IRS website.

Direct pay provides a powerful new tool for non-taxed entities to access solar incentives.

How "Commence Construction" Is Defined

- Incurring at least 5% of total project costs (services or materials integral to electricity generation), or

- Beginning physical work of significant nature (beyond site clearing or prep work).

Projects generally must maintain continuous construction progress and be placed in service within four years to keep eligibility.

Carrying Forward Unused Tax Credits

- May be carried back three years and

- Forward up to 22 years for projects placed into service after 2022.

This ensures businesses have flexible ways to capture full value, even across variable income years.

Summary

At Energy Independence Professionals (EIP), we help businesses maximize every opportunity to lower project costs and strengthen their investment.

We work on your side, not a sales quota.

Get Clarity on Solar—Without the Sales Pitch

No sales tactics—just real insight into your solar options, savings, and next steps.